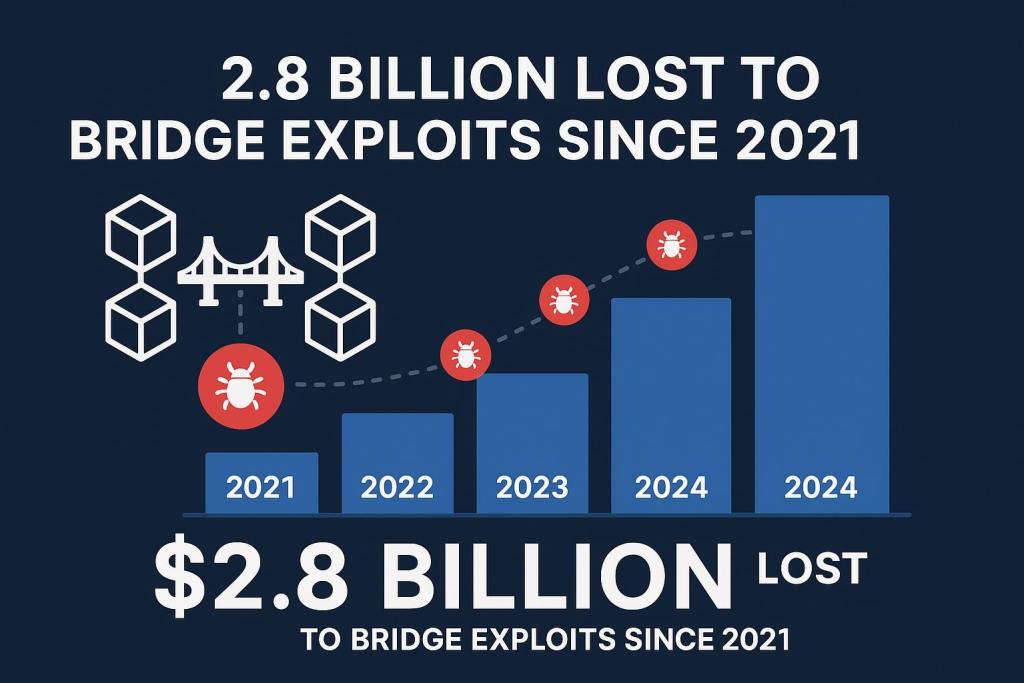

Blockchain technology’s path to mainstream adoption faces significant obstacles rooted in fundamental security vulnerabilities, with cross-chain bridges losing over $2.8 billion to exploits since 2021. Industry leaders emphasize that robust architectural design from the outset, rather than reactive security patches, will determine whether blockchain becomes critical global infrastructure.

The digital ledger technology, which records transactions across thousands of computers simultaneously rather than in centralized locations, promises to streamline economic systems by enabling direct, secure transactions without intermediaries. However, the fragmentation across numerous blockchain ecosystems has created severe integration and security challenges.

Complexity and Fragmentation Create Security Vulnerabilities

Wesley Crook, CEO of blockchain engineering firm FP Block, identifies complexity, scalability, and interoperability as the three primary barriers to widespread blockchain adoption.

“Developers often spend months rewriting code for different blockchains, systems buckle under real-world demand, and projects are locked into a single chain that may not meet their needs over time,” Crook explains.

This ecosystem fragmentation has produced particularly dangerous consequences in cross-chain bridge technology. Bridges, which connect different blockchain networks, have become prime targets for cybercriminals due to architectural weaknesses in their design.

Crook notes that since 2021, more than $2.8 billion has been lost through bridge exploits. “This highlights the fragility of current interoperability solutions. Instead of unlocking growth, poor design has exposed projects to massive security risks,” he says.

The scale of these losses demonstrates how tools intended to enhance blockchain utility can become critical vulnerabilities when security considerations aren’t prioritized during development.

Financial Institutions Develop Proprietary Blockchain Infrastructure

Major financial institutions are responding to competitive pressures and security concerns by building their own blockchain systems rather than relying on existing public networks.

Global payments network Swift announced a blockchain initiative developed in partnership with Bank of America, Citigroup, and NatWest. Swift, which connects over 11,500 financial institutions worldwide, is creating a shared digital ledger to support transactions in tokenized products, including stablecoins.

The organization stated the new system will “record, sequence and validate transactions, and enforce rules through smart contracts,” enabling “instant, always-on cross-border transactions possible at a massive scale.”

This strategic move directly responds to the $300 billion stablecoin industry dominated by issuers like Tether and Circle. Stablecoins challenge Swift’s traditional role by allowing users to transfer funds directly without intermediaries—a significant threat to legacy payment infrastructure.

A report from McKinsey & Company highlighted that stablecoins represent “a direct challenge to traditional global payments rails” like Swift because legacy systems often involve multiple intermediaries and can take up to five days to settle transactions.

To build its prototype ledger, Swift is collaborating with Consensys, a blockchain technology company led by Ethereum Co-Founder Joseph Lubin. This partnership brings together traditional financial infrastructure expertise with blockchain-native technical knowledge.

Architectural Discipline Required for Secure Interoperability

According to Crook, overcoming security and scalability challenges requires foundational architectural discipline from project inception rather than iterative experimentation. His firm frequently works on projects that collapsed under operational stress, demonstrating how expensive retroactive fixes become compared to proper initial architecture.

“Just as the internet became the backbone of communication and commerce, blockchain is on track to become the backbone of trust and value exchange,” Crook argues. “We believe interoperability will be the key to unlocking its mainstream role. Once enterprises and developers can build applications that work seamlessly across ecosystems, blockchain will shift from experiments and pilots to critical infrastructure in the global economy.”

To address these challenges, FP Block developed the KOLME framework, which allows each application to run on its own high-performance blockchain while maintaining interoperability with major ecosystems like Ethereum, Solana, and Cosmos.

The framework represents an architectural approach prioritizing security and performance from the ground up rather than attempting to retrofit these qualities onto existing systems.

Blockchain Security Fundamentals

Blockchain’s core security feature lies in its consensus mechanism—once data is entered, it cannot be changed without agreement from the entire network, providing transparency and accountability. This structure theoretically allows parties to transact directly and securely without needing intermediaries.

However, when multiple blockchains need to communicate and exchange value, the security model becomes significantly more complex. Bridge protocols must maintain security guarantees while facilitating asset transfers between chains with different consensus mechanisms, validation rules, and trust assumptions.

The $2.8 billion in bridge exploits reveals how these cross-chain security challenges have been underestimated. Many bridges use centralized validator sets or complex smart contracts that introduce single points of failure—exactly the vulnerabilities that blockchain technology was designed to eliminate.

Industry Evolution Toward Infrastructure Status

The blockchain industry stands at a critical juncture. The technology has proven its potential in specific use cases, from cryptocurrency transactions to supply chain tracking and decentralized finance applications. However, evolving from experimental technology to essential infrastructure requires addressing fundamental security and interoperability challenges.

Financial institutions like Swift entering the blockchain space with proprietary solutions demonstrates both the technology’s perceived value and the inadequacy of current public blockchain infrastructure for enterprise requirements. These organizations demand reliability, security, and regulatory compliance that many existing blockchain networks struggle to provide.

Crook’s emphasis on architectural discipline reflects a maturing industry perspective. Early blockchain development often prioritized rapid deployment and feature development over security and long-term scalability. The resulting technical debt—visible in bridge exploits and scalability limitations—now constrains industry growth.

The emergence of frameworks like KOLME represents a shift toward engineering-first approaches that treat blockchain development with the same rigor as mission-critical infrastructure. This evolution may prove essential for blockchain to achieve its promised role in the global economy.

Whether blockchain technology ultimately becomes as fundamental as the internet depends largely on solving these architectural challenges. The combination of proper security design, genuine cross-chain interoperability, and enterprise-grade reliability will determine if blockchain transitions from promising technology to critical infrastructure supporting global commerce and communication.